Renters in Gloucester Township’s apartment complexes—Lakeview, East Coast Fairways, East Coast Tory Estates, Jamestown, SDK Millbridge Gardens, and more—listen up: your rent may be on the line, and it’s time to pay attention. The township’s 2025 budget is flat, avoiding a tax hike during this mayoral election year. Sounds great, right? But here’s the catch: the township pulled it off with an $8 million windfall from reverse tax appeals targeting your apartment complexes. At GTObserver, we’re exposing this practice and urging renters to see the hidden cost baked into your monthly bills. You may not pay property taxes directly, but they’re in your rent—just like your sewer bill—and this budget trick could mean higher rents tomorrow.

Reverse Tax Appeals: A Budget Fix on Renters’ Backs?

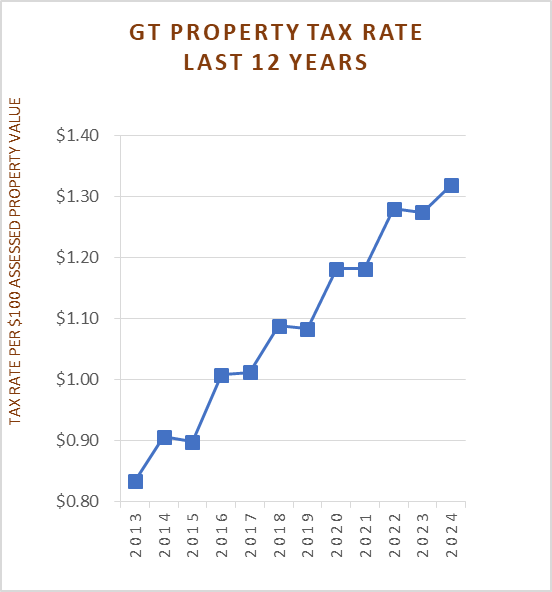

Every other year, Gloucester Township raises taxes, often by double digits in non-election years. But in election years like 2025, the township finds a way to keep taxes flat, sparing homeowners during a mayoral race.

This year, the magic bullet was reverse tax appeals. Two years ago, the township hired Blau & Blau, a tax appeal firm, to go after big apartment complexes, claiming their assessed values were too low. The targets? Your homes—Lakeview Apartments, East Coast Fairways, East Coast Tory Estates, Jamestown, SDK Millbridge Gardens, and others.

From 2018 to 2023, these appeals forced property owners to pay $8 million in retroactive taxes, as their assessments were jacked up. Blau & Blau pocketed a 21.5% commission—$1.72 million—for their efforts. That $8 million kept the 2025 budget flat, but here’s what renters need to know: when property owners get hit with massive tax bills, they don’t just absorb it. They pass it on. Higher assessments mean higher future taxes, and that cost often lands in your rent, just like your sewer bill does. It’s not a separate line item on your lease, but it’s there, quietly hiking what you pay to live in Gloucester Township.

Why Renters Should Be Furious

Think you don’t need to vote because you don’t pay property taxes? Think again. Property taxes are a core part of your rent, just like utilities or maintenance fees. When the township squeezes apartment owners with reverse tax appeals, those owners can—and often do—raise rents to cover the hit. The $8 million windfall helped the township avoid a 2025 tax increase, but at what cost to you? Renters at Lakeview or Jamestown or Millbridge could face lease hikes as owners adjust for retroactive taxes and higher future assessments. We don’t know the exact impact yet—rent increases depend on market conditions and leases—but the risk is real, and renters are left in the dark while the township cashes in.

Here’s what’s even more galling:

- The Township’s Double Game: Gloucester Township’s Tax Assessor sets property values, but the township appealed its own assessments, arguing they were too low. That’s right—they challenged their own work to rake in millions, and your complexes were the target.

- Who Gets the Cash?: Unlike regular property taxes, which are split with schools and Camden County, reverse tax appeal money stays 100% with the township. That $8 million didn’t help fund schools or county services—it just propped up the township’s budget, potentially at renters’ expense.

This isn’t just a budget maneuver; it’s a wake-up call. Renters, you’re footing the bill for the township’s flat-budget election-year optics, and it’s time to get mad.

Election Years and Renters’ Power

Gloucester Township’s budget dance is no secret: flat taxes in election years, big hikes when the spotlight’s off. The 2025 flat budget, fueled by reverse tax appeals, fits the pattern perfectly. But here’s the kicker: renters, you’re a huge voting bloc, and your voice matters. Many of you skip elections, thinking property taxes don’t touch you. Wrong. Every rent payment includes taxes, and decisions like reverse tax appeals hit your wallet indirectly. If you’re fed up with the cost of rent, November 4, 2025, is your chance to speak.

The township’s reliance on one-time cash grabs like reverse tax appeals isn’t a long-term fix. What happens in 2026, a non-election year? Will taxes spike again, pushing property owners to raise rents even more? Renters, you deserve transparency and a say in how township decisions affect your life.

Take Action Now

Renters, it’s time to open your eyes and use your power. Here’s how:

- Vote in 2025: Your rent reflects township policies—don’t sit out the mayoral election. Check voter registration at nj.gov/state/elections.

- Talk to your neighbors. Let others knows what is going on and where their hard earn money is going when rents go up.

- Demand Answers: Attend Gloucester Township council meetings (schedule at glotwp.com) and ask how reverse tax appeals impact rents. Are officials tracking effects on tenants?

- Share Your Story: Tell us how rent costs affect you by submitting a reply online or in the article below. Your voice can shape our coverage.

- Stay Informed: Dig into the township’s budget at glotwp.com or call the Tax Office (856-228-4000) to learn more. Knowledge is power.

Gloucester Township renters, you’re not just tenants—you’re residents with a stake in our future. Reverse tax appeals may have kept taxes flat for 2025, but they could raise your rent tomorrow. Get angry, get informed, and get to the polls. Your wallet depends on it.

This post reflects GTObserver’s analysis based on public information. For official budget details, contact Gloucester Township at 856-228-4000.